by 10 Leaves

Blockchain | Crypto

Consulting for the digital age – by a digital first consultancy.

Welcome to the first bespoke consultancy in the Metaverse!

by 10 Leaves

Consulting for the digital age – by a digital first consultancy.

Welcome to the first bespoke consultancy in the Metaverse!

The Metaverse

It is not often that a piece of technology comes along that not just changes a few things..it changes everything. A new paradigm, a new way of looking at the world itself.

A lot is being made of the metaverse, and many don’t understand it. And that is ok. One cannot fathom the depth of the ocean by merely glancing at it’s waters.

Dubai has always been at the forefront of everything exciting. So is the case with blockchain, crypto and the metaverse. We are excited to explore possibilities in this segment, and will be working on new dynamic solutions, to go hand in hand with new, dynamic technology.

Welcome to 10 Leaves.x

An ecosystem of pioneers in the web3, DeFi, blockchain and crypto space in the United Arab Emirates. Engage with early adopters, founders, investors, regulators and service providers to build a strong foundation for a vibrant blockchain-based ecosystem in the Middle East.

COMING SOON

10 Leaves

Rohit is the Founder of 10 Leaves. With over eighteen years of experience in the region, Rohit consults firms on corporate structuring, market entry strategies, fintech, fund structuring, regulatory authorisations and startup funding.

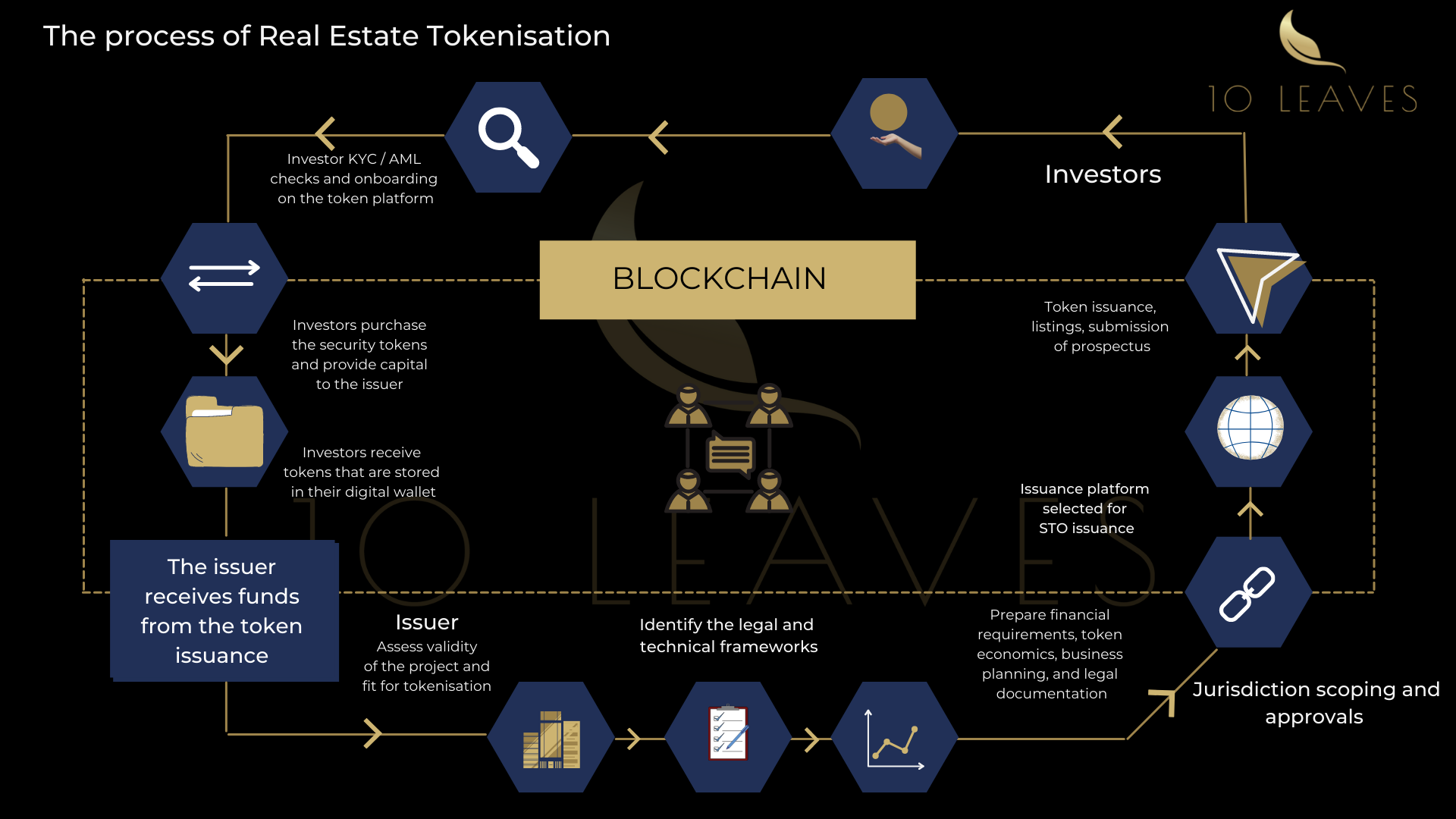

Rohit advises clients on legalities related to blockchain technologies and applications, including tokenization, DeFi and DApps, Tokenomics, STOs and secondary listings.

Master in Business Administration

Capabilities – Fintech, Blockchain, Funds, Venture Capital

Jurisdictions – DIFC, ADGM, UAE Mainland, DWTC, DMCC

Bishr established and headed the MENA office of the leading Luxembourg law firm, Arendt & Medernach for around 10 years, and has advised leading sovereign wealth funds, asset managers, MNCs and family offices in both Europe and the Middle East on e structuring of international transactions and the setting up of regulated and unregulated investment structures.

Certified Investment Fund Director (CIFD) & Master of Laws (L.L.M.) in International Economic Law.

Capabilities – Legal, Structuring, STOs and secondary offerings, Islamic Finance, Funds

Jurisdictions – DIFC, ADGM, Luxembourg, Europe

Soumen is a Master of Computer Applications and has over 20 years of experience in media and technology applications.

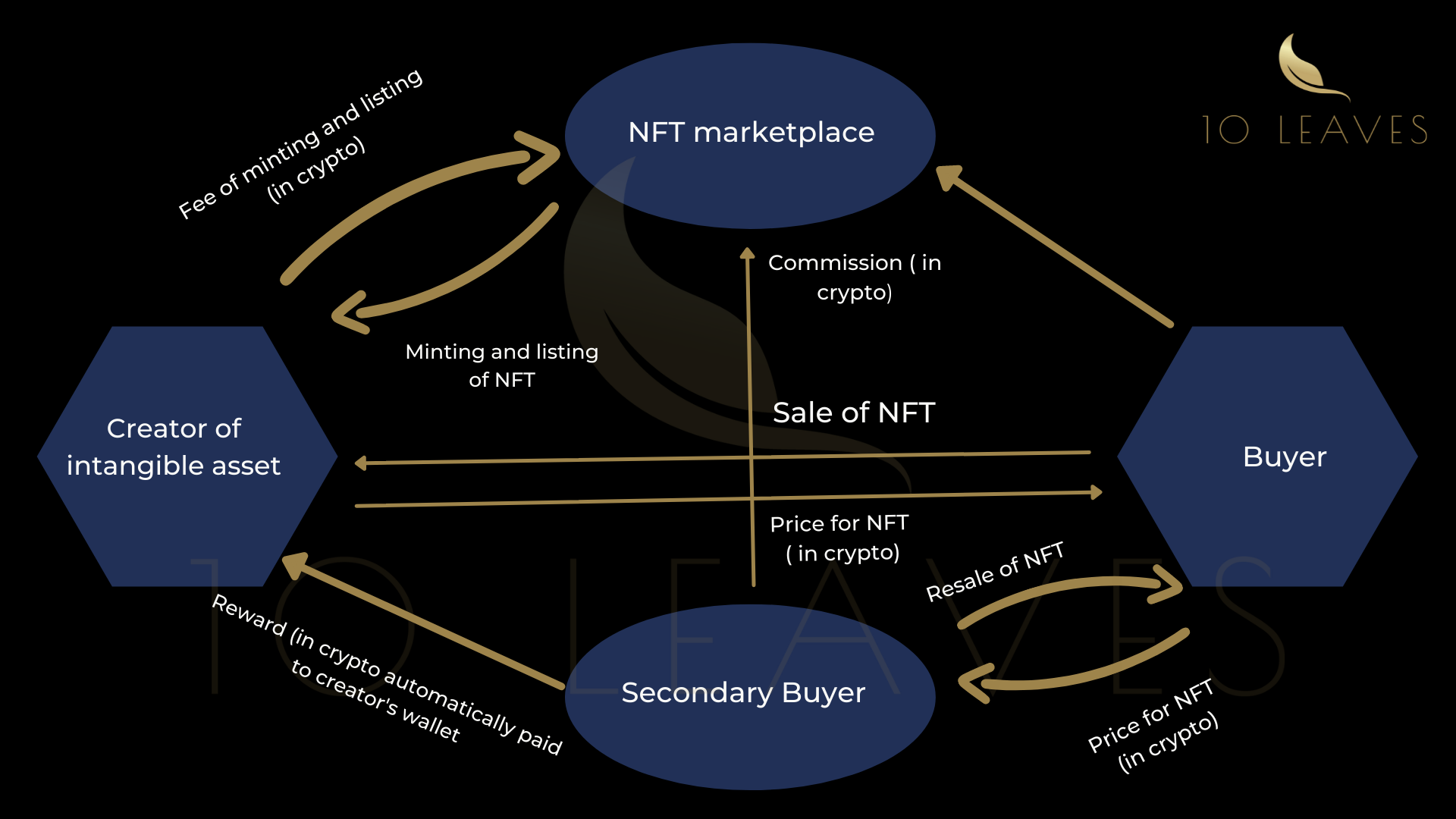

He has consulted international organisations on technology transformation and helped implement holistic media solutions across India and the United Arab Emirates. Soumen now consults on fintech applications in money services, robo-advisory and blockchain-related solutions. He is an active NFT creator, with profiles on OpenSea and Mintable.

Capabilities – Tokenisation, STOs and primary offerings, NFTs

Jurisdictions – DIFC, ADGM, India

From consultations to tokenomics to legalities of structuring your crypto business here in the United Arab Emirates, we help you demystify the process, and engage with you throughout the planning, implementation and operational stages…

in the united arab emirates

And more about NFT

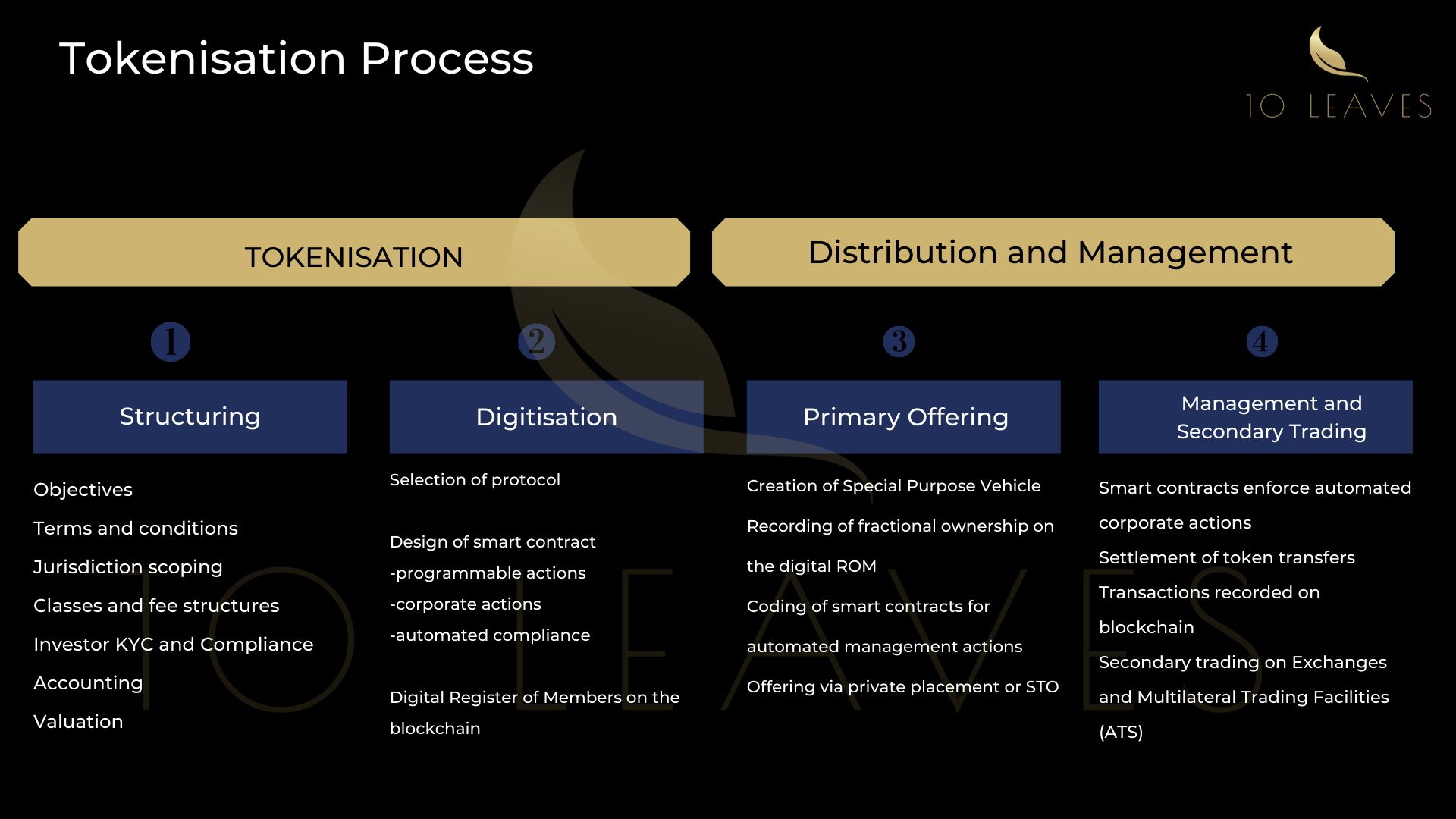

steps involved

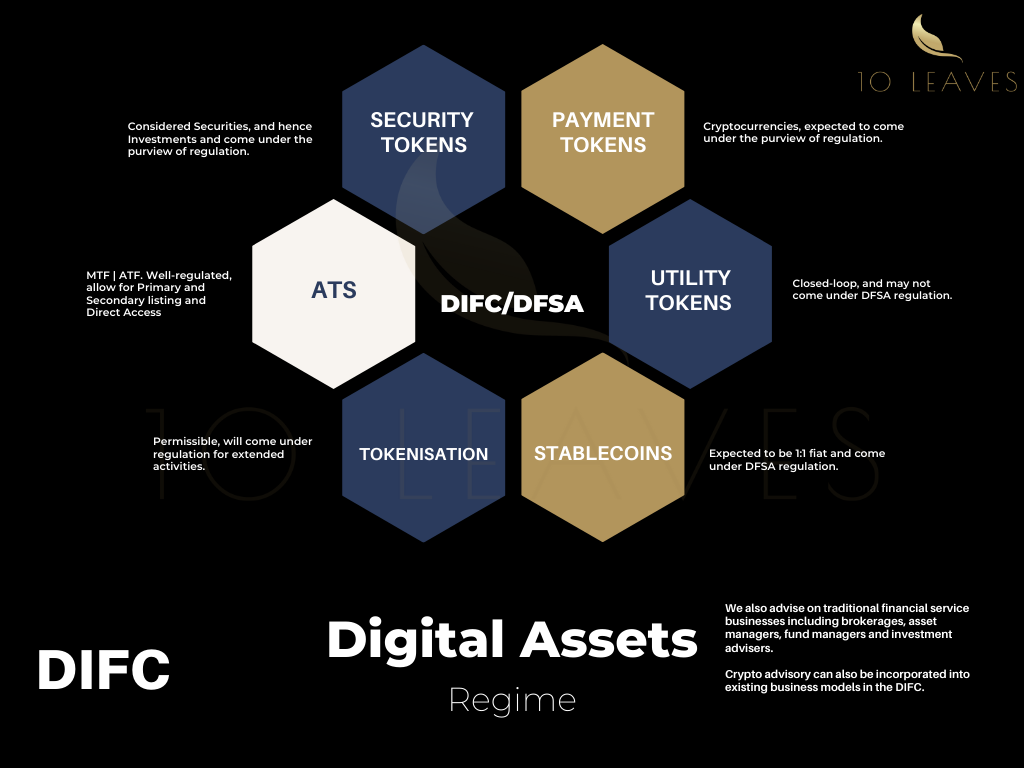

regime

in the difc

in the DIFC

The 10 Leaves Group, one of the region’s leading bespoke consultancies, will now accept crypto payments for their blockchain-related services and solutions.

With this, 10 Leaves becomes the first consultancy of it’s kind in the region to accept cryptocurrency payments, thus opening up their services to a wider audience of pioneers in businesses that work with Distributed Ledger Technology applications.

From fintech advisory, regulatory sandbox consulting to tokenization and legalities of smart contracts, the 10 Leaves Group is poised to advise it’s clients on blockchain-related implementations and regulatory licensing across DIFC, ADGM, DWTC, DMCC, Bahrain and Europe (Luxembourg and Lithuania).

We are